What is a Working Capital Loan?

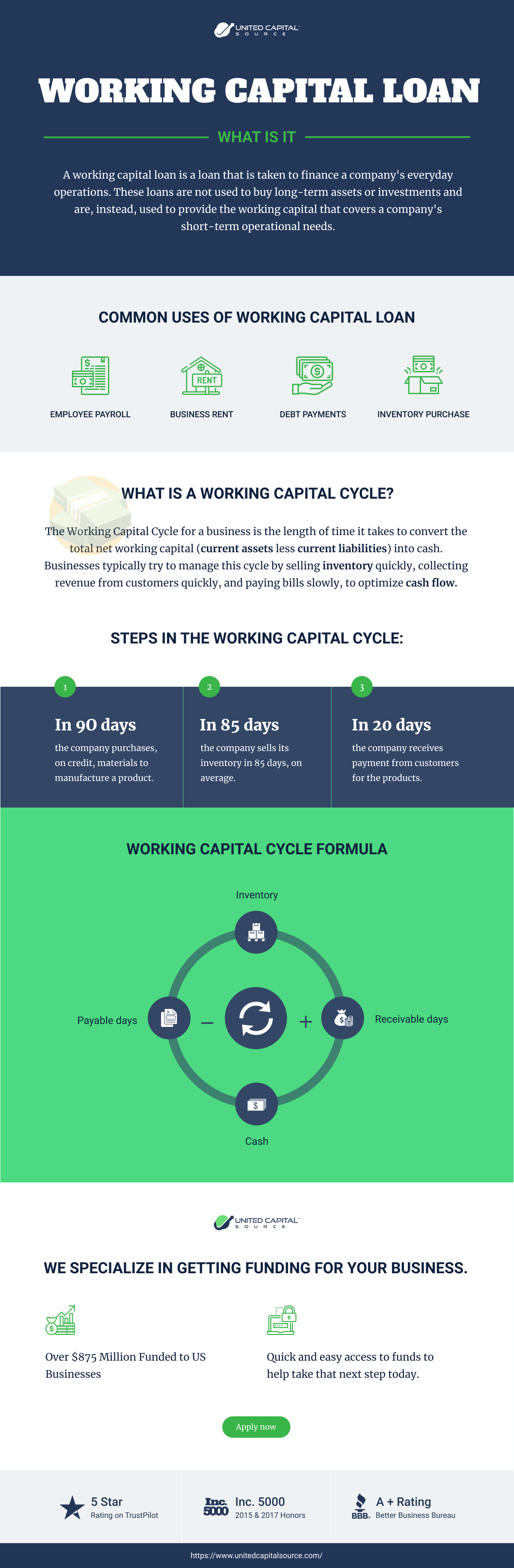

If you own a business and are looking into ways of getting help financing your expenses, you may be considering a working capital loan. A working capital loan is a loan that is taken to finance a company’s everyday operations. These loans are not used to buy long-term assets or investments and are, instead, used to provide the working capital that covers a company’s short-term operational needs. Businesses will often utilize a working capital loan for several reasons including:

- Employee payroll

- Business Rent

- Debt Payments

- Inventory Purchase

What is the Working Capital Cycle?

When considering a working capital loan, it is important to understand what the working capital cycle is, and how it works within your business. The working capital cycle for a business is the length of time it takes to convert the total net working capital (current assets less current liabilities) into cash. Businesses typically try to manage this cycle by selling inventory quickly, collecting revenue from customers quickly, and paying bills slowly, to optimize cash flow.

Working Capital Formula

The working capital formula is a simple calculation that will help you understand your business’s working capital cycle. Your working capital is always changing since your assets and liabilities are constantly changing, but to determine your working capital at any given time you can simply use this formula:

Working capital = Current Assets – Current Liabilities

Getting Funding for Your Business

United Capital Source specializes in funding for small businesses. They have matched more than $875 million in small business loans to thousands of businesses from a wide range of industries. As banks continue to make it hard for small businesses to source business funding quickly, United Capital Source continues to obtain the cash small business owners need to operate their businesses. Moreover, they get them funding fast. The goal is to get rid of the difficulties business owners encounter at traditional lenders and make it easy to get adequate and appropriate funding such as working capital loans, accounts receivable loans or a business line of credit.