[divider]

[divider]

Bitcoin marks the beginning of a new period of decentralized, open-source currencies that allow anyone to send money to anyone in the world without banks or clearing houses. Eliminating the middleman allows for a more efficient way to process transactions, which cuts costs for merchants and consumers. There are other benefits to crypto-currencies: they practically eliminate fraud.

The credit card industry is plagued with fraud. Credit card fraud is far too easy for criminals to pull off and there is little incentive for companies like Visa and MasterCard to change the status quo; fraud is simply written off as a business loss and the transaction is reversed. Payment systems like Bitcoin eliminate the risk to merchants as transactions are irreversible.

The Background

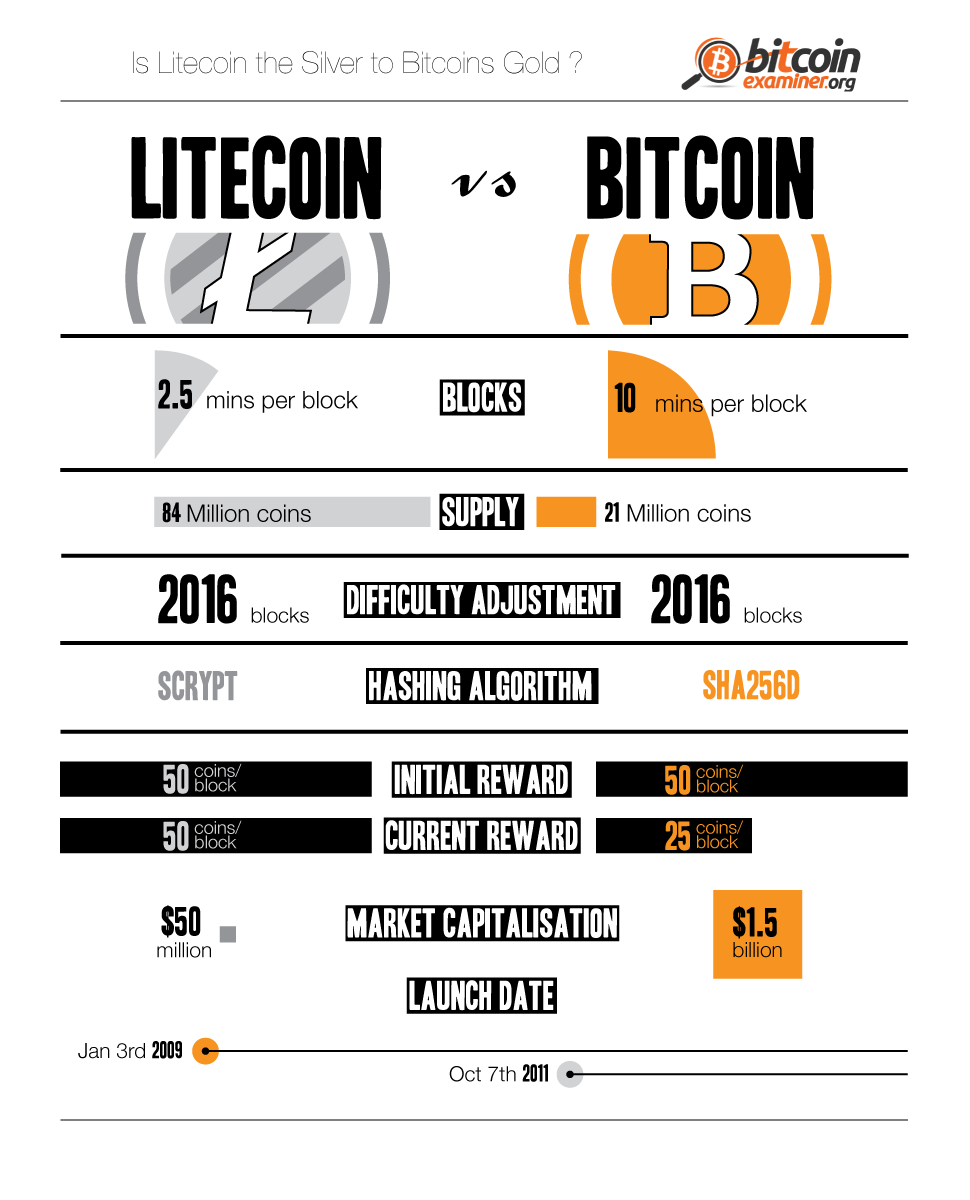

Bitcoin was create by an unknown hacker using the pseudonym Satoshi Nakamoto. Bitcoin was introduced in January of 2009, while Litecoin has only been around since October of 2011. To this day, no one knows for certain who created Bitcoin. Litecoin on the other hand, was developed by Charles Lee, a Google employee.

Comparing Bitcoin and Litecoin

Litecoin has the second largest market cap in the crypto-currency arena, under Bitcoin. While Bitcoin remains the media darling, Litecoin has been called the silver to Bitcoin’s gold, and has been quite the up-and-comer. Essentially, both currencies work in similar ways. They are both open-source, and require “mining” — using computing resources that solve complex math problems — to solve blocks. Every time a block is “solved” a certain number of coins are released as a reward to the miners.

- There are key differences between Bitcoin and Litecoin:

- Only 21 million Bitcoins are allowed to exist. Litecoin allows for 84 million total coins.

- Blocks are released every 10 minutes with Bitcoin. Litecoin releases a block every 2.5 minutes.